Payroll

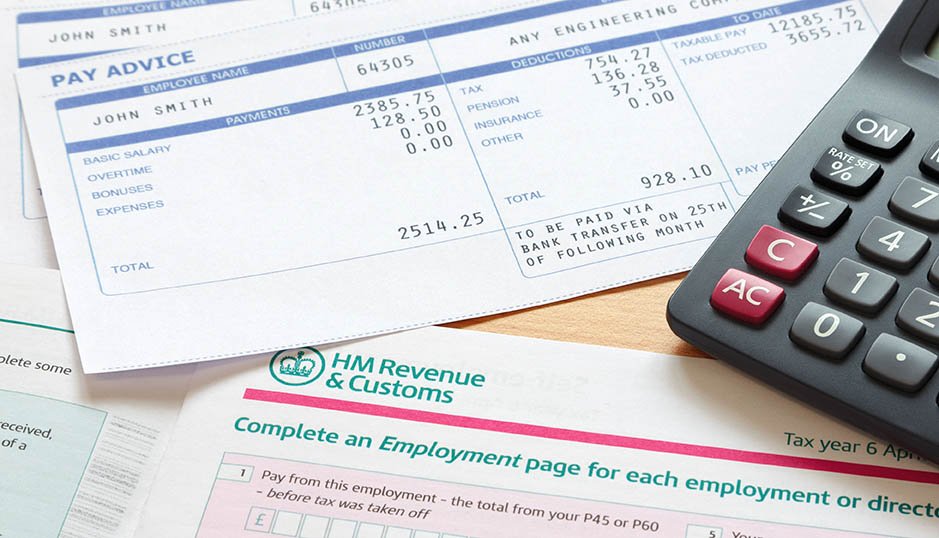

Cheylesmore Accountants take the complexity out of payroll processing, providing businesses across the UK with a reliable and hassle-free payroll service. Our expert payroll services ensure timely and accurate processing of employee wages, taxes, and deductions, allowing you to focus on your core business activities. With a team well-versed in the intricacies of payroll compliance, we provide peace of mind, knowing that your employees are paid accurately and on time, while keeping your business in full compliance with the latest tax and employment regulations. Let us handle your payroll, so you can concentrate on what matters most – growing your business.

The Importance of a Professional Payroll Service

Managing payroll can be a daunting task, especially for growing businesses with limited resources. A professional payroll service is essential for several reasons:

Compliance and Accuracy: Payroll processing requires meticulous attention to detail and adherence to ever-changing tax and employment regulations. A professional service ensures accurate calculations and timely compliance, reducing the risk of costly errors and penalties.

Time and Cost Efficiency: Outsourcing payroll saves valuable time and resources, allowing you to focus on strategic business activities rather than the nitty-gritty of payroll administration.

Employee Trust and Satisfaction: Timely and accurate pay is crucial for maintaining employee satisfaction and trust. A reliable payroll service ensures that your team is compensated accurately and on time, boosting morale and productivity.

Tax Efficiency: Payroll experts have a deep understanding of tax laws and can help optimise your payroll structure to minimise tax liabilities while ensuring compliance with all legal requirements.

The Benefits of Choosing Cheylesmore Accountants for Payroll Services

Tailored Solutions: At Cheylesmore Accountants, we understand that each business is unique. Our team customises payroll solutions to align with your specific requirements, whether you have a small team or a large workforce.

Seamless Onboarding: Transferring your payroll responsibilities to us is a breeze. We'll handle all the paperwork and data migration, ensuring a smooth transition with minimal disruption to your operations.

Accurate and Timely Payroll Processing: Our experienced payroll specialists are well-versed in managing complex payroll calculations, tax deductions, and statutory payments. You can trust us to ensure your employees are paid accurately and on time, every time.

Compliance and Legal Expertise: Compliance is our top priority. We keep up with the latest employment legislation and tax regulations to ensure your payroll is always in full compliance with the law.

Employee Support: Our team is ready to assist your employees with any payroll-related queries, offering a friendly and professional service that enhances the overall employee experience.

Cost-Effective Solution: Outsourcing payroll to us can be a cost-effective option compared to maintaining an in-house payroll department, saving you money on staff salaries, software, and infrastructure.

Confidentiality and Security: We understand the sensitivity of payroll data and maintain strict confidentiality and data security measures to protect your information.

Our Payroll Process:

Data Collection: We gather all necessary employee data, including hours worked, overtime, deductions, and any other relevant information.

Payroll Calculation: Our experts accurately calculate wages, taxes, and statutory deductions, ensuring compliance with tax laws and employment regulations.

Payslip Generation: We generate clear and concise payslips for each employee, providing a transparent breakdown of their earnings and deductions.

Tax and Statutory Payments: We handle all payroll-related tax payments and statutory deductions, submitting them on time to the appropriate authorities.

Reports and Analytics: We provide comprehensive payroll reports, giving you insights into labor costs, tax liabilities, and other key payroll metrics.

Ensure compliance using Cheylesmore Accountants Payroll services

With Cheylesmore Accountants as your payroll partner, you can rest assured that your payroll is in capable hands. Our expert team will manage all aspects of payroll processing, saving you time, ensuring compliance, and boosting employee satisfaction. Trust us to handle your payroll needs, allowing you to focus on growing your business and achieving long-term success. Contact us today and experience the convenience and reliability of our professional payroll service.

Contact us.

info@cheylesmore.com

(02476) 017-778