Self Assessment Tax Return

Welcome to Cheylesmore Accountants, your trusted partner for hassle-free Self Assessment Tax Returns. Our dedicated service ensures accurate and timely filings, taking the stress out of tax season. With our team of experts, you can rest assured that your self assessment tax return is handled with precision, maximising deductions and tax benefits while ensuring compliance with UK tax laws. Focus on what matters most – let us handle your tax affairs efficiently and professionally. Join countless satisfied clients who have entrusted their tax responsibilities to Cheylesmore Accountants. Experience the convenience and peace of mind of our Self Assessment Tax Return service today.

What is Tax Return

A tax return is a document used by individuals, self-employed individuals, and certain businesses to declare their income, capital gains, and claim tax allowances and reliefs. It enables HMRC to calculate the tax liability for the tax year and whether any tax is due or if a refund is owed.

Filing a Personal Tax Return in the UK is a legal requirement for certain individuals and businesses.

By understanding the process and seeking professional advice when needed, you can navigate the complexities of self assessment and meet your tax obligations efficiently and accurately.

Who needs to prepare a tax return?

Various circumstances require an individual to prepare and file a tax return. If you fall into one of the following categories, you may be obligated to submit a tax return:

Self-employed individuals and sole traders

Company directors (unless the company is non-profit and you receive no payment or benefits)

High-income earners (earning over a certain threshold)

Individuals with income from multiple sources, such as property rental, savings, investments, or foreign income

When do I need to file a tax return?

The tax year in the UK runs from April 6th to April 5th of the following year. The deadline to file a tax return is typically January 31st following the end of the tax year. For instance, the deadline for the tax year ending on April 5, 2023, would be January 31, 2024. It is crucial to submit your tax return on time to avoid late filing penalties.

When is my tax liability due?

Your tax liability, which is the amount of tax you owe to HMRC, is typically due on the same deadline as filing your tax return, which is January 31st. If you fail to pay your tax liability by this date, you may incur interest charges and penalties.

How to register for an HMRC Tax Return?

To register for a tax return, you need to visit the official HMRC website and create a Government Gateway account. During the registration process, you will be asked for your National Insurance number and other personal information. Once registered, HMRC will send you a Unique Tax Reference (UTR) that you will need when filing your tax return.

Where can I find my UTR (Unique Tax Reference)?

Your UTR can be found on any previous tax returns, correspondence from HMRC, or on your online HMRC account once you have registered for self-assessment. If you are unable to locate your UTR, you can contact HMRC for assistance.

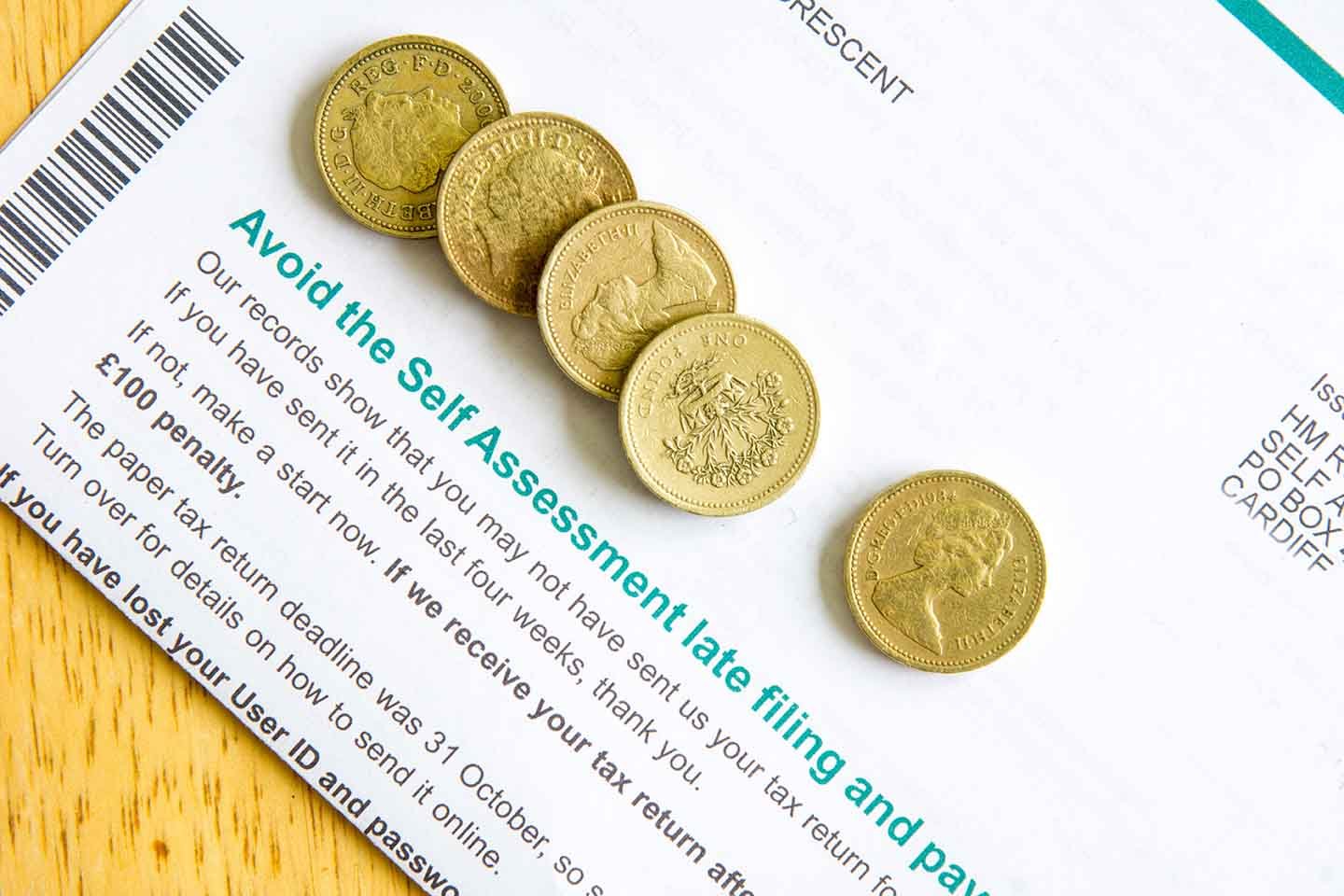

What are the late filing penalties?

Failing to file your tax return on time can lead to penalties. The penalties are as follows:

£100 if your tax return is up to three months late

Additional £10 per day up to a maximum of £900 if it's three to six months late

Additional £300 or 5% of the tax due (whichever is higher) if it's six to twelve months late

Additional £300 or 5% of the tax due (whichever is higher) if it's more than twelve months late

How can an accountant help with my tax return?

An accountant can be a valuable asset when preparing your tax return. They have a thorough understanding of tax laws and can help you maximise deductions and tax credits, ensuring you pay the correct amount of tax. Additionally, they can guide you through complex tax issues, keep you compliant with regulations, and submit your tax return accurately and on time.

What are the late filing penalties?

Failing to file your tax return on time can lead to penalties. The penalties are as follows:

£100 if your tax return is up to three months late

Additional £10 per day up to a maximum of £900 if it's three to six months late

Additional £300 or 5% of the tax due (whichever is higher) if it's six to twelve months late

Additional £300 or 5% of the tax due (whichever is higher) if it's more than twelve months late

The Benefits of Our Self Assessment Tax Return Service

Expert Guidance

Our self assessment tax return service provides access to highly skilled tax professionals with in-depth knowledge of UK tax laws. We ensure expert guidance tailored to your finances, maximizing deductions and handling complex scenarios accurately. Trust us for a compliant, error-free tax return.

Reduced Errors and Penalties

Our meticulous approach prevents costly mistakes that attract HMRC penalties. Rest assured, your tax return will be filed accurately and on time, keeping you compliant with regulations.

Time-saving Convenience:

With our efficient self assessment tax return service, you can save valuable time. Let us handle the paperwork and calculations while you focus on your priorities. Enjoy peace of mind knowing we've got your tax needs covered.

Peace of Mind

Choose Cheylesmore Accountants for reliable self assessment tax return service. Our team ensures professionalism, giving you confidence that your tax affairs are managed efficiently.

Maximised Deductions

Benefit from our expertise in identifying all eligible deductions and tax credits. We aim to minimize your tax liability and potentially increase refunds. Our proactive tax planning ensures you optimise your tax position legally.

Personalised Support

We understand your unique financial situation. Our self assessment tax return service offers tailored assistance, addressing queries and complexities to make the process seamless and stress-free. Rely on us as your trusted tax partner

Contact us.

info@cheylesmore.com

(02476) 017-778